The CUALA Endowment Fund gives Eagles the chance to donate towards a number of credible initiatives aimed at promoting the Eagles community in various ways. These include initiatives such as the Eagles Scholars Award, Business Support, Welfare Programs, Educational & Tuition Support, and other programs/initiatives in celebration of the 20th anniversary of Covenant University.

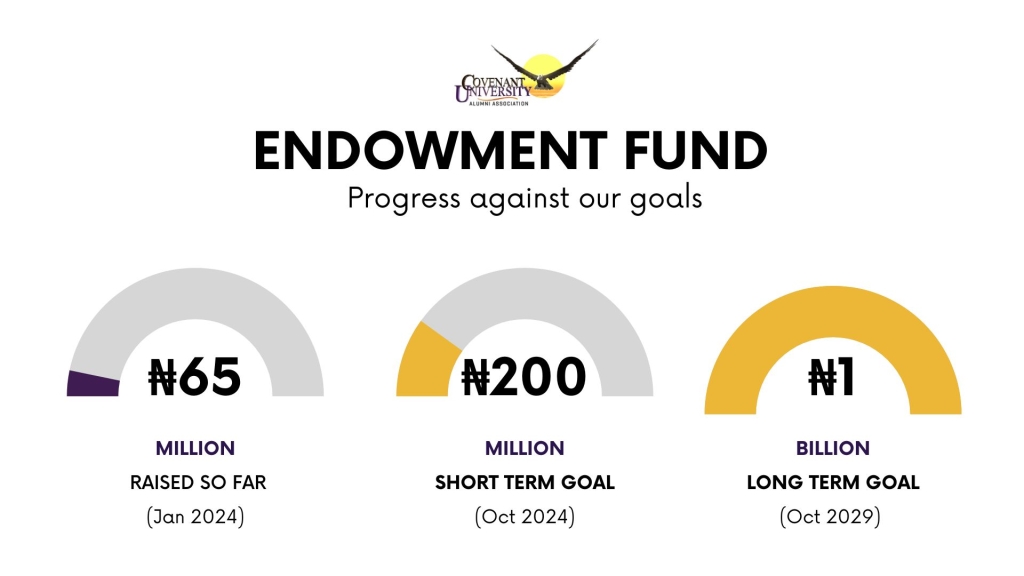

Covenant University Alumni Association (CUALA) is determined to raise a target Fund value of ₦1 billion by 2029.

You can donate by making a transfer to the account details below or clicking on any of the links below to donate!

- Bank: Zenith Bank

- Account Name: Covenant University Alumni Association

- Naira Account Number: 1228351716

- USD Account Number: 5074016517

- GBP Account Number: 5061294847

- EURO Account Number: 5081032193

Thank you to all our corporate donors

Meet the Endowment Fund Committee (EFC)

A 7-member committee of CU graduates (5 Eagles nominated by the community and 2 CUALA EXCOs) with diverse skills and specialities was set up to manage the fund.

The committee members are responsible for;

- Coordinating fund raising activities

- Reviewing and approving investment vehicles

- Monitoring compliance with the investment policy

- Reviewing performance and overseeing management of the investment portfolios

- Ensuring the utilisation of the fund in line with defined investment guidelines

- Reporting on the performance of the endowment fund.

EFC Chair

EFC member

EFC member

EFC member

EFC member

Ex-Officio Members

President (Interim)

VP Finance

How will we manage the Endowment Fund

The CUALA Endowment Fund would be activated for disbursement from June 2023 and to ensure the appropriate management of this fund, the following measures have been put in place:

- A fund management policy has been developed to guide its utilisation and accountability, including periodic reporting and annual independent valuation

- A 7-member committee of CU graduates (5 Eagles nominated by the community and 2 CUALA EXCOs) with diverse skills and specialities has been set up to manage the fund.

- Proposals from asset management firms were reviewed for fund management services

- Annual independent fund valuation reports would be published from 2023 onwards.